This protection might be obtained through the rental company. insured car. Caution: Failure to abide by these requirements could lead the Division of State to take serious action against the benefit to run Car(s) in the United States. Better, regardless including a mishap or injury, the Division of State plans to ask for an appropriate waiver of immunity if legitimate insurance claims are not pleased. affordable car insurance.

You and also member of the family listed on the plan are also covered when driving somebody else's cars and truck with their authorization. It's extremely crucial to have enough obligation insurance coverage, because if you are included in a significant accident, you might be demanded a big sum of cash. credit. It's advised that policyholders purchase more than the state-required minimum obligation insurance, sufficient to shield possessions such as your house as well as cost savings.

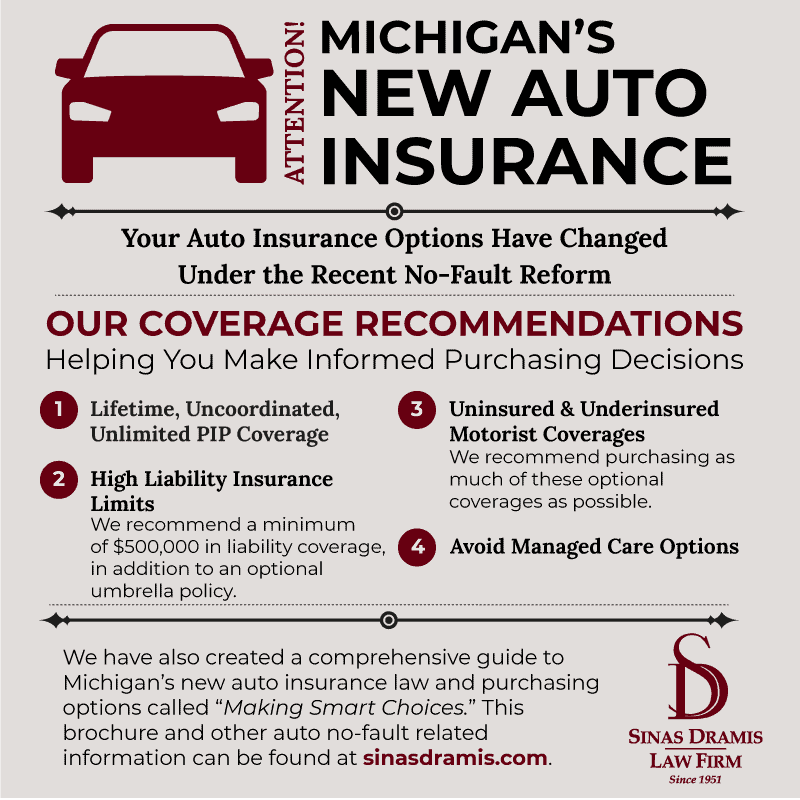

At its widest, PIP can cover medical settlements, shed salaries and also the price of changing services normally performed by a person wounded in a vehicle mishap. It might likewise cover funeral expenses. Home damage obligation This insurance coverage spends for damage you (or someone driving the automobile with your authorization) might create to somebody else's property. insurance.

It likewise covers damage triggered by holes.

If you're not at fault, your insurance policy business may try to recover the quantity they paid you from the various other vehicle driver's insurance firm and also, if they achieve success, you'll also be reimbursed for the deductible - cheap car insurance. Comprehensive This protection reimburses you for loss due to theft or damage triggered by something aside from a collision with an additional vehicle or things.

liability auto prices suvs

liability auto prices suvs

Buying car insurance coverage? Here's exactly how to discover the appropriate policy for you and also your automobile. - dui.

What Does New Jersey's Basic Auto Insurance Policy Do?

It willgive you two original NY State Insurance policy ID Cards (see a example) or provide you with accessibility to your digital electronic NY State Insurance ID Card send out a digital notice of insurance policy protection to the DMV (your insurance policy agent or broker can not submit this notification) Your NY State Insurance Identification Cards and the electronic notification of insurance policy verify your insurance policy coverage.

trucks liability insure money

trucks liability insure money

Bring one copy or kind of your Insurance coverage Identification Cards with you. car insurance. The DMV office will certainly keep the paper card. Maintain the other paper card with the car as your proof of insurance. Any person running your vehicle needs to have the ability to give evidence of insurance while they are operating the lorry.

cars car insured insured car car

cars car insured insured car car

Your insurance policy cards have to have the very same name as the name on your lorry enrollment application. Yes. Nonetheless, the DMV will not accept a card if the DMV barcode viewers can not check out (check) the barcode. We will approve out-of-state vehicle insurance policy protection of any kind of kind. If your vehicle is signed up in New York, it should have New York State auto responsibility insurance policy protection.

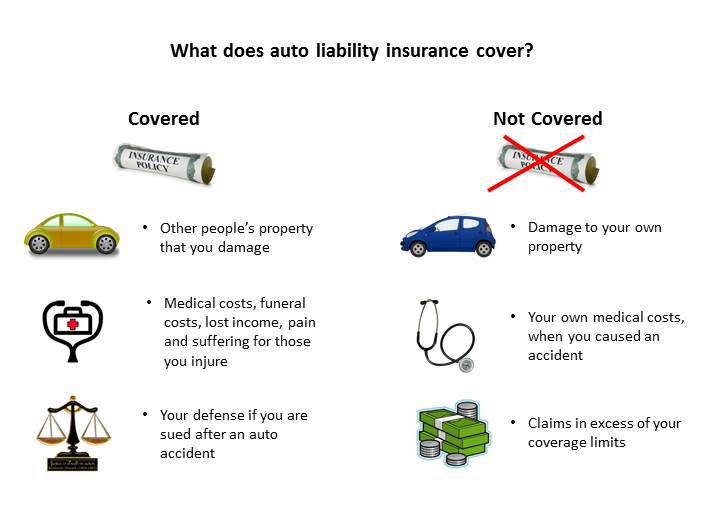

Liability-only auto insurance coverageResponsibility cars and truck insurance policy protection is the part of your policy that spends for the injuries as well as damages you trigger to somebody else in an at-fault vehicle crash. auto insurance. Most states require chauffeurs to carry at the very least a minimal car insurance policy coverage limitation, frequently called "minimal protection." Nevertheless, you can get higher obligation restrictions than required by your state and still have a "liability-only" policy, as long as you do not add insurance coverage for damage to your lorry.

This portion of your obligation protection pays for the problems you cause to one more's property, such as one more car, a fence or a structure. Liability coverage is frequently noted as split limits, which are provided in a physical injury each/ bodily injury per accident/ property damage per mishap layout.

car vehicle cheap car insurance affordable

car vehicle cheap car insurance affordable

Some states likewise call for various other insurance coverage types as component of their minimum protection requirements, including: This coverage spends for your clinical bills and also your passengers' medical expenses if you are injured in a mishap, no matter fault. PIP may additionally pay for lost wages and also the costs for household solutions you can't execute because of injuries - laws.

The 7-Minute Rule for Liability Car Insurance: Cost And Coverage – Forbes Advisor

These 2 insurance coverage types spend for injuries you endure if you are hit by a driver that does not have insurance coverage or does not have enough insurance policy to cover your bills - cheaper auto insurance. This also gives protection if you are a pedestrian hit by an uninsured motorist or a target of a hit-and-run mishap. liability.

It spends for your injuries and the injuries to your travelers regardless of fault. Nonetheless, medical settlements protection does not cover lost salaries or family solutions like PIP. You should acquire a car insurance plan with a minimum of your state's minimum called for insurance coverage types and limitations in states where automobile insurance coverage is needed. affordable auto insurance.

Full insurance coverage cars and truck insurance coverageComplete protection automobile insurance refers to a policy that has all the state-required coverage types in addition to detailed as well as accident coverage, which add insurance coverage for damage to your automobile - cheap car insurance. While it's possible to have a complete coverage policy with reduced obligation limitations, several complete insurance coverage plans have higher limitations for responsibility protection to use even more robust protection and greater economic defense for you as well as your family.

Expense by state, The state you reside in effects your vehicle insurance rates to a high level. Each state has its own automobile insurance policy laws, accident data, criminal activity rates and also expense of living variations, which all influence the price of a cars and truck insurance coverage (laws). The state you live in significantly influences your automobile insurance policy premium, both for minimal coverage and also full insurance coverage.

A woman with a DUI conviction is likely to pay greater prices than a man with a clean driving record (affordable Helpful resources car insurance). Male $1,778 $539 Women $1,764 $551 Male normally pay higher costs than women, yet sex isn't a score consider all states. Additionally, other rating variables might have more of an influence on your rates than your gender - low cost auto.